Crypto is riding high once again. Bitcoin just reached a new all-time high of $111,814, Coinbase became the first crypto company in the S&P 500, and a growing pipeline of industry firms are looking to go public in the suddenly frothy crypto market.

Add to the list Animoca Brands: a Hong Kong-based Web3 company, whose shares trade on private markets, has its tentacles in everything from NFTs and crypto gaming to an investment platform that includes over 500 companies, such as the crypto exchange Kraken and Ethereum development studio ConsenSys.

The firm, which was delisted from the Australian Stock Exchange in 2020 as a result of its crypto ties, grew from a $100 million to a $5.9 billion valuation in 2022, coming full circle during the pandemic. However, it fell from the public eye during the crypto winter, the NFT crash, and then the subsequent memecoin mania. It also did not help that the GameFi craze failed to capture much attention from what Oppenheimer & Co estimates to be a $180 billion global gaming industry.

Undaunted, the company under CEO Yat Siu continued to build. It has now carved out a profitable business strategy for his firm. According to unaudited financials published on the company’s website, last year Animoca made a profit of $97 million, a 185% jump from 2023.

And now, the company is among the multitude of global firms exploring increased commercial ties to the U.S. as a result of the crypto-friendly Trump administration, including a potential public listing on a prominent exchange such as Nasdaq or the New York Stock Exchange. “We think that the U.S. is going to be the biggest crypto market in the world, so it’d be kind of foolish for us not to try and enter that market,” said Siu in an interview with Unchained, though he is careful to say that a U.S. listing is one of several opportunities that the company is currently exploring.

What type of reception will Animoca get? That will depend on whether GameFi and NFTs can refill the top of their funnel and whether investors buy Animoca’s narrative as the best picks-and-shovels play of the GameFi movement.

Game Off

Although the global gaming industry is largely immune to Trump’s specific tariffs, it remains highly vulnerable to the changing macroeconomic climate. “Overall the industry is doing okay, though not as well as it did in Covid,” says Martin Yang, senior analyst, equity research at Oppenheimer & Co. “We went through a two-year period of very strong growth, but now the growth rate overall is maybe 3-6% per year.”

Things are even more troubling for the mobile gaming market, which is where GameFi has primarily existed. That seems somewhat counterintuitive to outside observers because of mobile games’ freemium models and considerably lower costs, but it is an important nuance to understand about the gaming industry as it explains why crypto gaming has struggled to take hold.

“I think the feeling was, ‘Oh, people either don’t pay at all or they pay just a little bit for games,’ and so it was felt that [the mobile game model] would be defensible and a challenging macro environment,” said Mike Hickey, senior analyst at The Benchmark Company, in an interview. “But starting a few years ago, in fact, we learned that it was the most vulnerable market.” He went on to say that even a lot of the major independent mobile gaming studios, such as Zynga, have been acquired and many have faced layoffs.

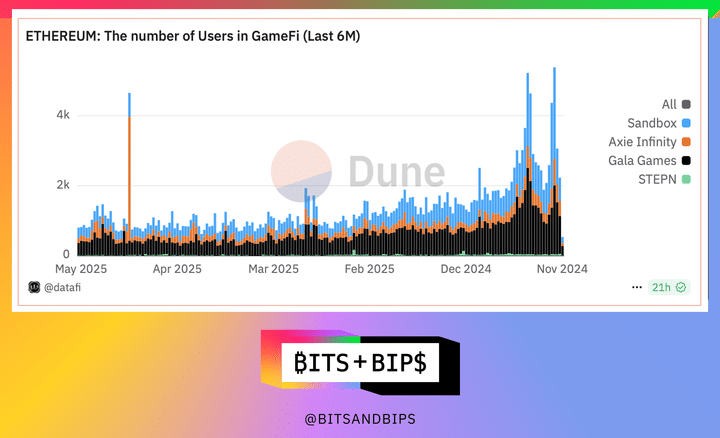

How do these trends align with crypto? The data shows that GameFi has struggled, though this phenomenon has also likely accelerated from GameFi having a much smaller base of committed users than the broader gaming market. Using data from Ethereum, the dominant blockchain for the sector, key metrics such as transactions and users have dramatically dropped off, as demonstrated in the charts below (the second should be read from right to left).

Animoca’s B2B Play

In this climate it would seem surprising for Animoca to almost 3x its profitability from one year to the next. But that is exactly what it achieved. How? By becoming the primary liquidity engine, or market maker, for GameFi. Siu realized that it is steadier and safer, and perhaps even more lucrative, for Animoca to be the financial plumbing back end for these companies than trying to launch even more games into an already crowded environment. “That’s the business evolution,” says Siu. “We know that a lot of smaller companies out there who launch a game don’t have this financial infrastructure or know how to do it. We buy their tokens and do capital market support, like over the counter desks. It sounds financial in nature, but it’s really just an extension of what we call a publishing business.”

How did this impact its business? Well, in 2023, most of its revenue came from its Web3 operating activities, which include wholly owned projects like virtual worlds, chess games, and an online education platform. But that revenue dropped 39.5% from 2023 to 2024, an extremely bullish year for crypto. Yet the company’s profit surged 185% year on year. How? It saw 114% growth in its Digital Asset Advisory business, which is where all of this capital markets activity resides.

Can It Last?

Delta-neutral strategies like market making can be profitable both inside and outside of crypto, and the numbers indicate that Animoca has found product-market fit for its unique expertise in the sector. But investors buying into the business will need to be confident that it can continue growing this line of revenue, especially if key GameFi metrics continue to struggle.

This question is harder to answer. One data point that can shed light is decentralized exchange (DEX) trading volume for the GameFi tokens mentioned above. As demonstrated in the following chart, which just looks at Ethereum-based tokens, the trend is similarly negative, though volumes do meet a few hundred-thousand dollars per day. The trends are the same for other blockchains such as Polygon and BNB.

This matters because DEX volumes are a more honest representation of real user demand for certain tokens, as opposed to CEX volumes, which are deemed to be more for speculation purposes. It is unclear what percentage of this volume also comes from Animoca’s work on behalf of clients, which is an important blind spot for investors.

Refilling the Pipeline

An optimistic reading of Animoca’s performance is that the company has found a profitable way to operate until it can catch the next GameFi wave, assuming that one comes. For this, Siu tells me that President Trump’s embrace of the crypto market will be particularly important as the sour regulatory climate in the U.S. has precluded major U.S. gaming companies from moving into the sector.

“We work with large institutions and essentially red pill them into crypto,” he said. “[Around the world] there’s some comfort to do it, but in the U.S. it might be harder to talk to [the big gaming companies]. They actually talk to us regularly to say, ‘Hey, tokens are interesting, we should look at it.’ But …when there’s not a hundred percent clarity on the legality of something [the legality of tokens], then you take the guesstimate of the lawyer.” Siu’s implication here is that the initiative will be denied.

If, and it’s a big if, Siu and Animoca can get one of these big guys on board, such as EA Sports, it could solve another major problem for crypto games, which is that they are not very fun to play and that players have not reacted well to the over-financialization of their industry. “When you take a normal game experience and try to bolt on something to it that’s just a monetization mechanic and doesn’t enhance the game experience, gamers revolt against these sort of corporate-led strategies on monetization,” says Hickey.